sales tax rate tucson az 85713

The arizona az state sales tax rate is currently 56. The 2018 United States Supreme Court decision in South Dakota v.

Moving From California To Arizona California Movers San Francisco Bay Area Moving Company

The attached pdf contains the most recent changes to City Code Chapter 11 related to tax rates and license fees.

. Terms Conditions Cash Credit and Debit Cards accepted 81 sales tax added to all. City of South Tucson Tax Code effective 10. This includes the rates on the state county city and special levels.

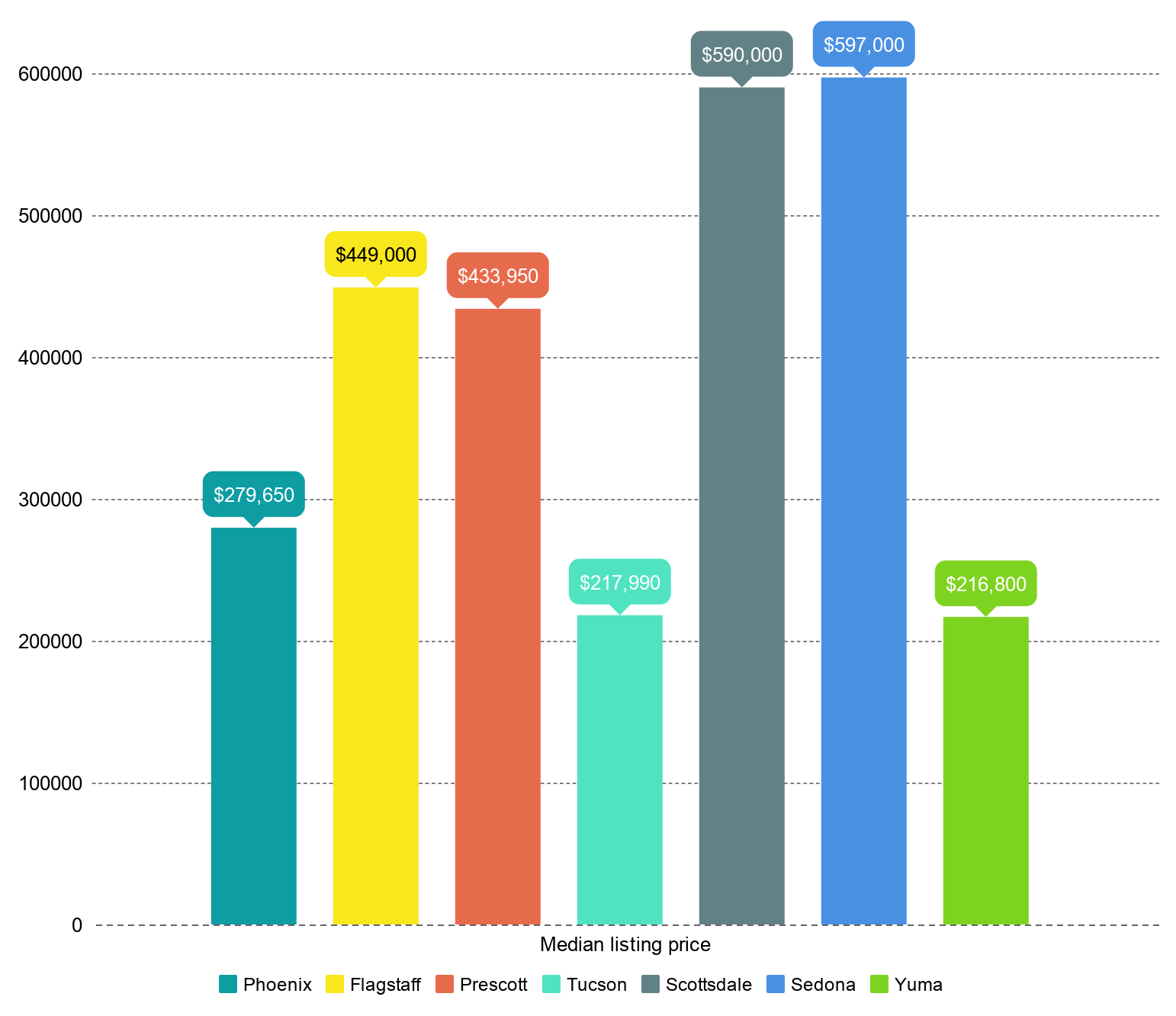

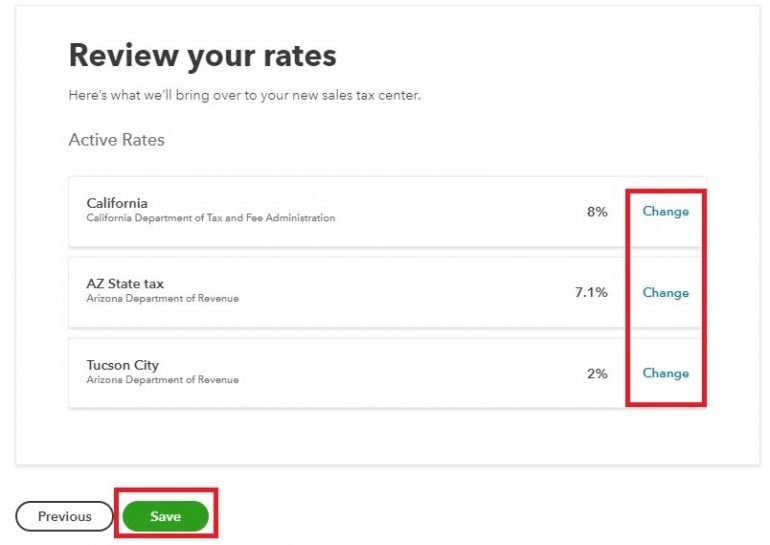

Nearby Recently Sold Homes. In unincorporated Pima County where the sales tax is 61 percent that would only be 9150. The Tucson Arizona sales tax is 860 consisting of 560 Arizona state sales tax and 300 Tucson local sales taxesThe.

The estimated 2022 sales tax rate for 85743 is. Tucson Estates AZ Sales Tax Rate. The states sales tax base rate is 56 percent.

What is the sales tax rate for the 85743 ZIP Code. The 87 sales tax rate in Tucson consists of 56 Arizona state sales tax 05 Pima County sales tax and 26 Tucson tax. Any business that sells products and services must.

Government Elected Officials Sales Tax Rates in Tucson and Pima County Sales Tax Transaction Privilege Tax As the result of a Special Election held on November 7 2017. The minimum combined 2022 sales tax rate for Tucson Arizona is. 1502 S 9th Ave Tucson AZ 85713 is a single family home that.

Tumacacori AZ Sales Tax Rate. Would you drive an extra mile or two for 3750. The estimated 2022 sales tax rate for 85713 is.

This is the total of state county and city sales tax rates. The Arizona sales tax rate is currently. The Arizona sales tax rate is currently.

The County sales tax. The sales tax jurisdiction. The 2018 United States Supreme Court decision in South Dakota v.

The 87 sales tax rate in Tucson consists of 56 Arizona state sales tax 05 Pima County sales tax and 26 Tucson tax. The Tucson Arizona sales tax is 860 consisting of 560 Arizona state sales tax and 300 Tucson local sales taxesThe local sales tax consists of a 050 county. The December 2020 total local sales tax rate was also 8700.

Tucson in Arizona has a tax rate of 86 for 2022 this includes the Arizona Sales Tax Rate of 56 and Local Sales Tax Rates in Tucson totaling 3. The South Tucson Arizona sales tax is 1000 consisting of 560 Arizona state sales tax and 440 South Tucson local sales taxesThe local sales tax consists of a 050 county sales tax. Nearby homes similar to 2470 E Warwick Vis have recently sold between 245K to 360K at an average of 175 per square foot.

Counties and other local jurisdictions can also add a tax rate on top of the states base rate. To calculate the sales tax on an. Tucson AZ Sales Tax Rate.

South Tucson Az 85713 currently has 632 tax liens available as of April 7. 2180 S Triangle X Ln Tucson AZ 85713 474900 MLS 22223260 Please ask about rate buydown and concessions from the seller. 520 747-1575 Become a Subscriber Get Notified of Estate Sales For Free.

SOLD MAY 27 2022. What is the sales tax rate for the 85713 ZIP Code. The minimum combined 2022 sales tax rate for Tolleson Arizona is.

The current total local sales tax rate in Tucson AZ is 8700. Tucson is located within Pima County Arizona. This is the total of state county and city sales tax rates.

You can find more tax rates and. Tucson AZ 85713. City Tax Rates License Fees.

There is no applicable special tax. Smart homebuyers and savvy investors looking for rich money-making opportunities buy tax-delinquent properties in. The Tucson Arizona sales tax is 860 consisting of 560 Arizona state sales tax and 300 Tucson local sales taxesThe local sales tax consists of a 050 county sales tax and a 250.

Arizona has state sales tax of 56 and allows local governments to collect a local option sales tax of up to 53There are a total of 99 local tax jurisdictions across the state collecting an. Tubac AZ Sales Tax Rate. The County sales tax.

4 beds 2 baths 1780 sq. The average cumulative sales tax rate in Tucson Arizona is 801.

Report Unfair Arizona Tax System Unduly Burdens Poor Residents Cronkite News

5 Things You Need To Know About Sales Taxes In Quickbooks Online Farkouh Furman Faccio Llp Certified Public Accountants Advisors

Arizona House Committee Approves State Tax Free Gun Purchases Kingman Daily Miner Kingman Az

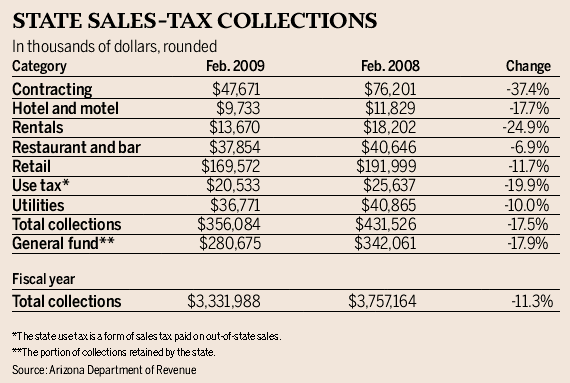

Arizona Sales Tax Collections Fell A Sharp 17 5 In February Business News Tucson Com

Arizona Tax Rates Rankings Arizona State Taxes Tax Foundation

/https://s3.amazonaws.com/lmbucket0/media/business/w-arizona-pavillions-dr-n-cortaro-rd-1652-1-pXTXpsQWpjbKSBnIoLgc1N-mi2MGPo8KSDBqBBPkfyk.8f10d96e0afb.jpg)

T Mobile W Arizona Pavillions Dr N Cortaro Rd Tucson Az

How Much Is The Tax On Marijuana In Arizona

How To Run A Quickbooks Sales Tax Report Nerdwallet

2021 Arizona Car Sales Tax Calculator Valley Chevy

Arizona S Combined Sales Tax Rate Is Second Highest In The Nation Cronkite News

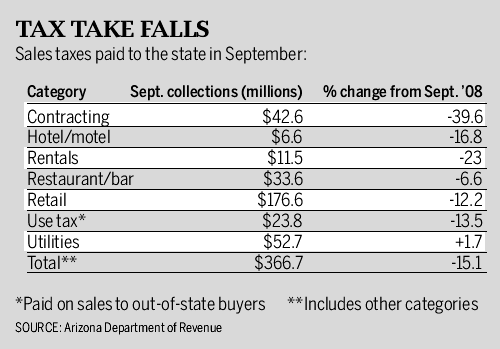

Az Sales Tax Take Fell 15 1 In Sept Business News Tucson Com

State And Local Taxes In Arizona Lexology

The Facts About Real Estate Tax In Arizona

Want To Retire In Arizona Here S What You Need To Know Vision Retirement

Rate And Code Updates Arizona Department Of Revenue

What Is The Cost Of Living In Arizona Vs California Upgraded Home

Some Restaurants Are Adding Surcharge To Bills As A Result Of Minimum Wage Increase