pay indiana state tax warrant

What is a tax warrant. A Tax Warrant is not an arrest.

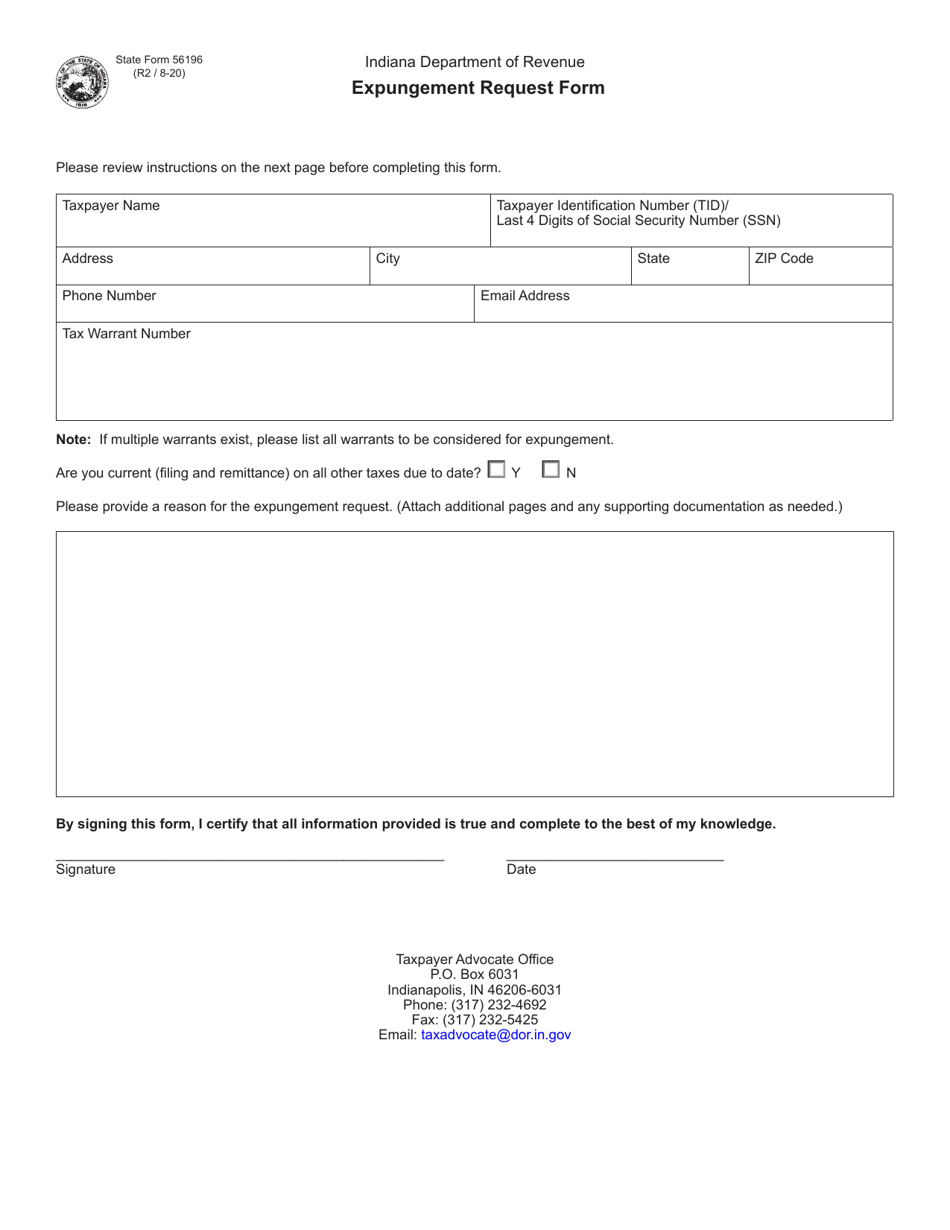

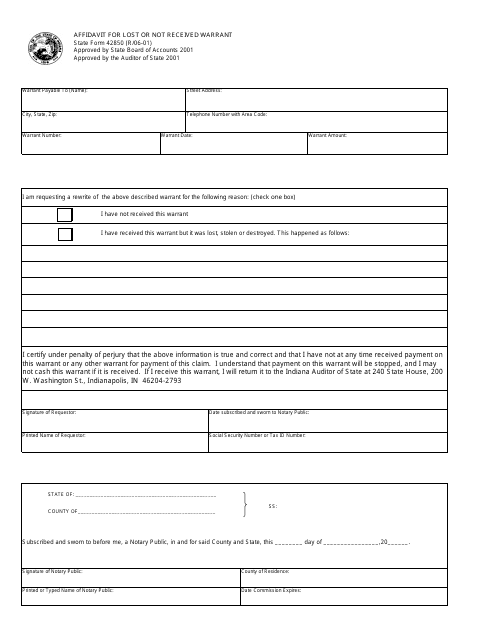

State Form 42850 Download Fillable Pdf Or Fill Online Affidavit For Lost Or Not Received Warrant Indiana Templateroller

File my taxes as an Indiana resident while I am in the military but my spouse is not an Indiana resident.

. Marion county indiana tax warrant search Marion county indiana state tax warrant search. These should not be confused. Contact the Indiana Department of Revenue DOR for further explanation if you do not understand the bill.

Tax Warrants The Sheriff of Porter County is authorized to collect taxes due to the State of Indiana. Know when I will receive my tax refund. 1 First The Indiana Department of Revenue itself attempts to collect your Indiana back tax debt by sending you demands via US.

My pension is from a company based in another state. Automatically generate notifications for the taxpayers. What can I do to be sure I am meeting all Indiana tax obligations for my business.

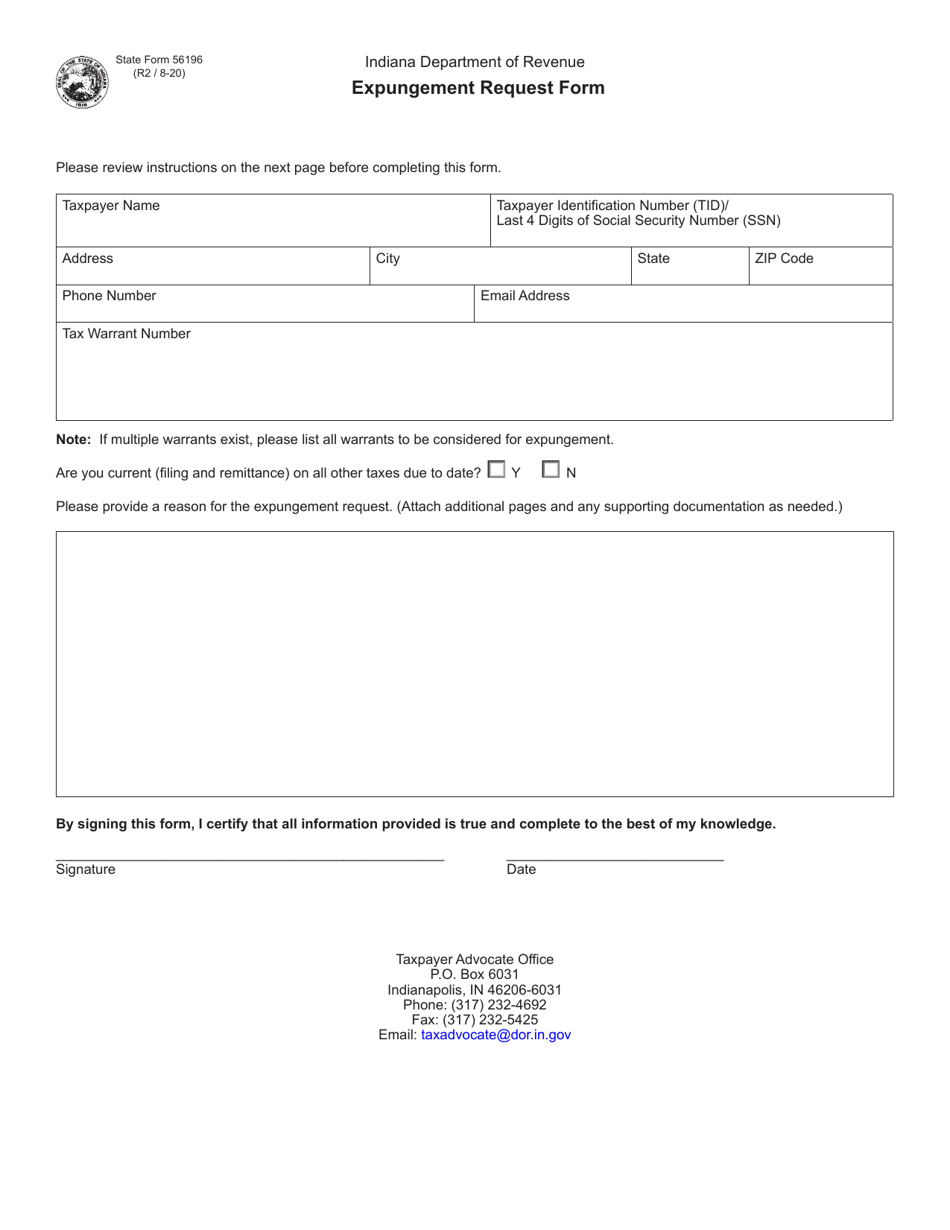

Eligible taxpayers may request a tax warrant expungement for tax liabilities that have been resolved through the Indiana Department of Revenue DOR. Trusted A BBB Member. How do i check if i have a.

File Settle Back Taxes. Under IC 6-81-3 and IC 6-81-8-2. There are three stages of collection of back Indiana taxes.

Eliminates ALL data entry of tax warrant information. Built for Indiana Sheriffs. Answer 1 of 2.

Plan A is to take care of your taxes early on to avoid penalties and interest a tax warrant and a tax lien on your credit report which stays on your credit for seven years. Possibly Settle Taxes up to 95 Less. A tax warrant is a notification to the county clerks office that a taxpayer owes a tax debt and that the debt will be referred to the county sheriff or a.

That process begins when the DOR mails tax warrants to Clerks who hand write the. Ad Get Your Free Tax Review. If you wish to dispute the amount owed please contact the Indiana Department of.

Find Indiana tax forms. The Sheriff of the county is tasked with assisting in the collection of monies owed to the Indiana Department of Revenue through a process of Tax Warrants. File Settle Back Taxes.

Our service is available 24 hours a day 7 days a week from any location. March 18 2022 0013. Almost one third of Indiana counties were processing tax warrants manually when this project started.

What is a tax warrant in indiana. Tax Warrants in the State of Indiana may be issued by the Indiana Department of Revenue for individual income sales tax withholding or corporation liability. Ad Get Your Free Tax Review.

Do i have a tax warrant in indiana. INcite e-Tax Warrant application or otherwise receiving the warrants electronically do not need to record tax warrant judgments in the county judgment docket because an electronic tax warrant. Payment may be made in person at the.

A tax warrant is a legal action that can be brought against you by the state or federal government if you fail to pay your taxes. What state is it taxed in. Call us at 518-457-5893 during regular business hours and speak with a representative to request we send proof your warrant has been paid in full or if you have other.

Possibly Settle Taxes up to 95 Less. The Indiana Department of Revenue DOR is in the process of moving to its new online e-services portal INTIME which will soon offer all customers the ability to manage tax accounts in one. Tax warrants that remain unsatisfied are returned to the Department of Revenue for further action resulting in additional costs to the taxpayer.

Trusted A BBB Member. Analysis Comes With No Obligation. Make a payment online with INTIME by electronic check bankACH - no.

Doxpop provides access to over current and historical tax warrants in Indiana counties. Also called a lien the warrant is a public. Trusted Reliable Experts.

Analysis Comes With No Obligation. Pay online using MasterCard Visa or Discover at the Indiana state government ePay website see Resources. Trusted Reliable Experts.

State Form 42850 Download Fillable Pdf Or Fill Online Affidavit For Lost Or Not Received Warrant Indiana Templateroller

Irs Announced Federal Tax Filing And Payment Deadline Extension The Turbotax Blog

Unfortunate But Familiar Indiana Dwd Warns Of Rise In Unemployment Fraud Wane 15

/cloudfront-us-east-1.images.arcpublishing.com/gray/BUPZWJA4RZJIZLDGJZTK6MLYMA.jpg)

Berrien County Treasurer S Office Warns Residents Of Scam Letter

Rabine Blames 2017 Tax Lien On Ides Pledges To Pay Legitimate Debt Eyewitness News Weht Wtvw

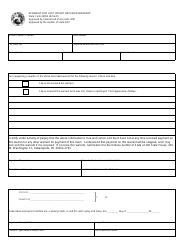

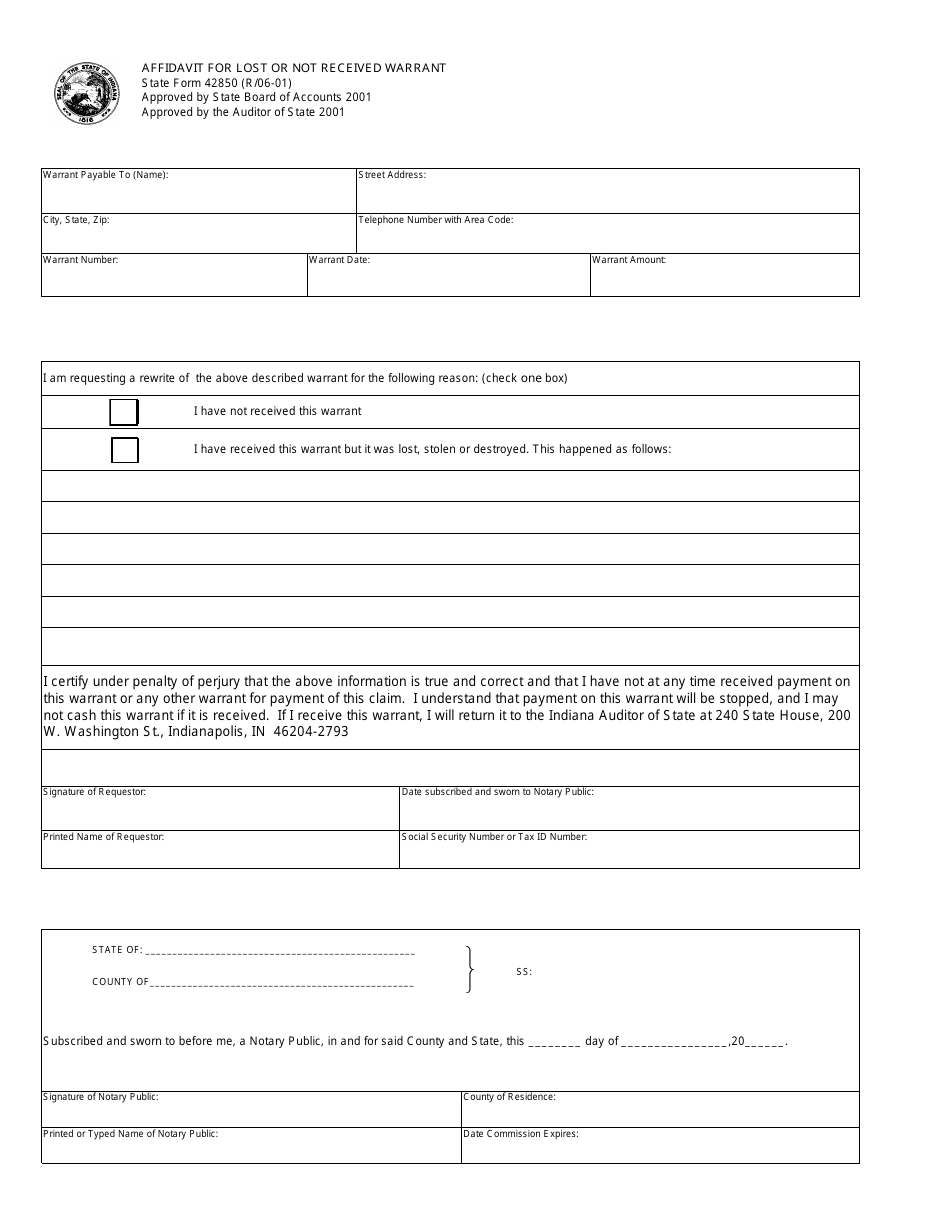

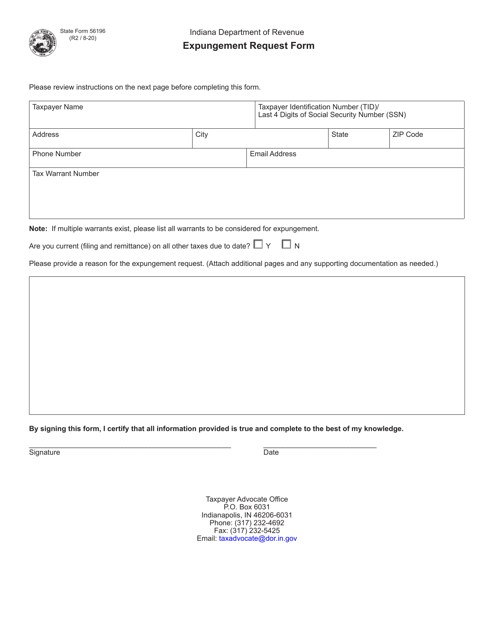

State Form 56196 Download Fillable Pdf Or Fill Online Expungement Request Form Indiana Templateroller

Dor Indiana Individual Income Tax Tips Payments And Refunds

Greenwood Police Warn Residents Of Tax Scam Fox 59

Dor Act Quickly To Avoid Late Fees Or Penalties

Certified Letter From Irs Why Irs Sent Certified Mail

State Form 56196 Download Fillable Pdf Or Fill Online Expungement Request Form Indiana Templateroller

State Form 42850 Download Fillable Pdf Or Fill Online Affidavit For Lost Or Not Received Warrant Indiana Templateroller

Scam Alert Letter Being Sent That Threatens Property Seizure If Taxes Aren T Paid

Dor Indiana Extends The Individual Filing And Payment Deadline